Roku (ROKU)

First look at Roku (ROKU). Learning about streaming platforms, the business model, market dynamics and my concerns with the business and management.

What is Roku? That’s how most of my research in companies start. I have no idea what the company/product is and if it seems interesting enough I’ll dig in.

The more interesting it gets, the more I might be inclined to dig in. The higher level the analysis remains, its an indication that I got bored with it rather quickly. This would probably do better as a disclaimer for all future and past writeups but it’s the thought I have as I think about writing out my thoughts about Roku.

Initial Curiosity.

My first spark came from looking through Pat Dorsey’s 13F (the required filing to show his US portfolio holdings for those unfamiliar). Dorsey has a concentrated style and as his thesis is focused on moats (his books/podcasts are quite entertaining on this ‘moat’ topic) I like to look at his portfolio from time to time. I saw Roku there but thought nothing of it.

Then, I heard it a few more times on various podcasts I listen to and given multiple references to how it was similar to SPOT’s business model, I thought it would be worth a look.

Quick History

The history of Roku was interesting too. It was founded in 2002 by Anthony Woods (current CEO). He previously founded ReplayTV, which competed with TiVo. It seems like it was a product designed to ‘replay’ shows. He sold it to SonicBlue and while there, created a version that could skip ads and then it got sued by MGM, Disney and media big dogs until the company went bankrupt…. Is how I interpreted the story.

But, Woods had the idea for Roku in 2002 and brought it to Reed Hastings of Netflix. Woods joined Netflix in 2007 and built it out as part of Project Griffin. It was eventually ‘axed’ given possible conflicts with Netflix wanting to be on other platforms, so Roku was spun out. It launched its first hardware in 2008 and created Roku TV to be embedded in Smart TVs in 2014.

Soon after, it IPO’d in 2017.

My interest grew because I was wondering if this meant Netflix was somehow affiliated with the business… and if this was going to be how Netflix planned on incorporating ads into its business. I mean, I’d hate to see ads played on Netflix but I probably wouldn’t cancel my subscription if ads popped out.

Still.. What is it?

I don’t have a Smart TV. I have a not-so-smart TV from 2012… the resolution is so weak on it that high def stuff looks blurry. I think that’s what it means. I do own a chromecast and Apple TV so that’s my reference point to what Roku is.

Roku is a TV streaming platform software. All kinds of OTTs (over-the-top) content providers like Netflix, Hulu, HBO Max, Disney etc.. are on it. As well as its own Roku Channel that includes free/paid channels.

It delivers this software through streaming sticks (like chromecast, Apple TV or Amazon Fire) that you plug into a not-so-smart TV like mine or you get a Roku TV, which is a Smart TV with the Roku software built into it.

Is it Popular?

Apparently. As of 2019, there were ~37M active accounts. An account can have multiple viewers (like family-style) and is considered active if it was streamed over 30 days. Pairing this is the ~40B+ hours of content streamed in 2019.

This comes out to ~3hrs of streaming per day per account. Apparently, the average American watches 4 hours of TV a day.

Roku also says that ⅓ of TVs purchases in the US are Roku TVs (they have partnerships with Walmart’s onn, TLC and Hisense to name a few).

It would seem quite popular as people slowly convert to Smart TVs… I mean, why wouldn’t you?

Market share?

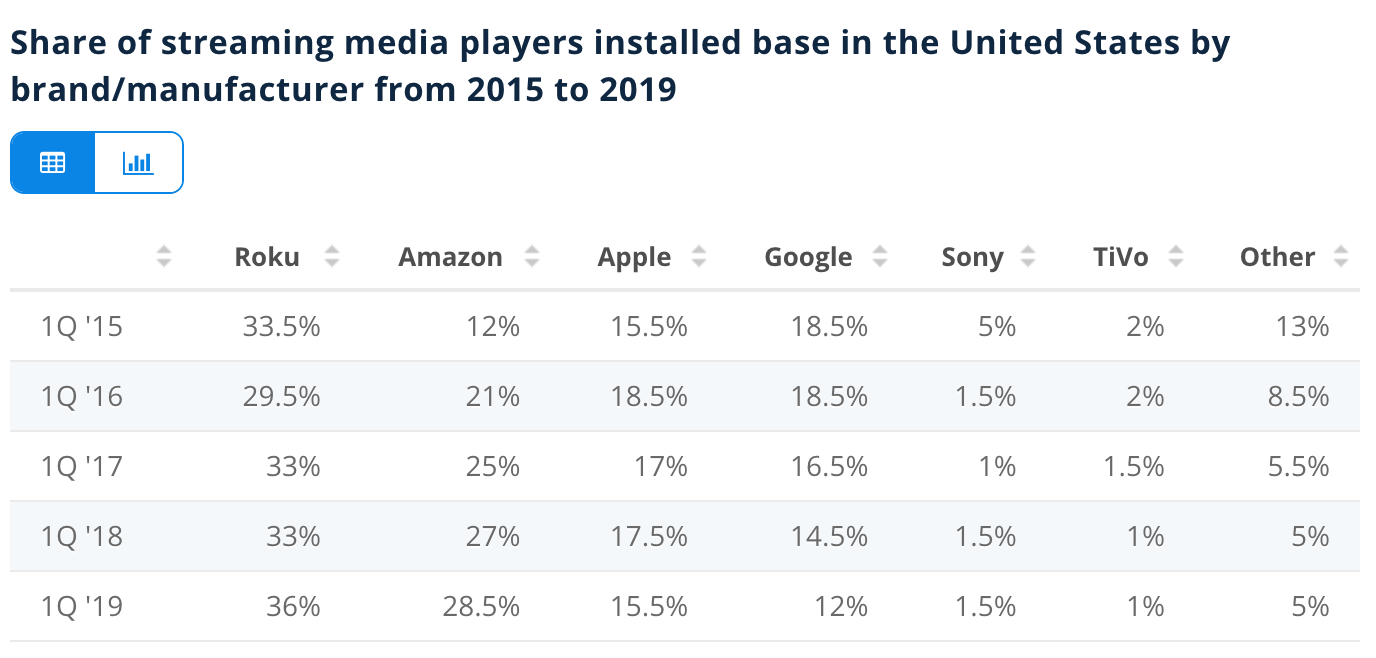

There are various competitors in the market but it seems like Roku is a leader in the US. According to Parks Associates, Roku had a 39% market share in the streaming media player (SMP) market with Amazon behind at 30%. This is per 2019 Q1 results.

https://www.statista.com/statistics/614740/us-streaming-media-player-sales-share-by-brand/

Statista shows something similar too. It seems like this is by device count. The major players seem to be Roku, Amazon (Fire TV), Apple TV, and Google (Chromecast + Android TV). Where do these big 3 not compete?

But, like with SPOT, the company focused on the singular product is leading the market crowded with the better financed/larger behemoths.

Are devices the best measure of market share though? Because that doesn’t necessarily translate to revenue. Apple has less devices out there than Android but it’s still a massive company making a ton of cash.

Per MarketingDive’s early 2020 article: “Roku was the most popular brand of streaming devices based on total ad spend, delivering 53% of available monetized OTT ad inventory last year. That was ahead of Amazon Fire TV (14%) and Google's Chromecast (8%), while the remaining 25% was split among other devices. Those streaming devices delivered 77% of OTT ads, ahead of 19% for smart TVs and 2% for gaming consoles.”

Since Roku makes its money on OTT ads, maybe the market demand/usage of OTT ad inventory paints a better picture of how advertisers actually value each platform?

Making Money

How does the utility tie with economic value for Roku? Two segments: Platform & Player.

It’s quite like the ‘razor + razor blade’ model for Roku. The Player segment is the sale of streaming players and the costs associated include all kinds of manufacturing costs. It makes practically no gross profit on the players but the players allow for the software to be utilized to create the Platform revenue.

Platform revenue includes everything done on the software like ads, subscription/transaction revenue shares and content distribution.

Back in 2015, the Players accounted for ~80% of total revenue and it seems the business model is working out as intended with Platform growth outpacing Players.

For Platforms there are 3 primary business models:

Transaction video on demand (TVOD) = a-la carte purchases in software

Subscription video on demand (SVOD) = Roku takes a cut of new subscriptions set up in software

Advertising supported video on demand (AVOD) = channels that have no subscriptions to users

Management has noted AVOD is the fast growing segment and I’d imagine this is where the ad dollars are flowing from. Ads can be placed during streams, in the home page or sleep page. There might be some other inventory but these are the ones I remember distinctly.

Though they have devices servicing North America, South America and Europe… most ad revenue is earned in the US. No geographic breakdown was provided.

What’s Special About This?

There is the big cord-cutting movement. The behavioural/technological shift to streaming becoming the main form of viewing content. Sports is probably the only exception… though I do stream past Formula 1 races.

It seems that the long investors are viewing Roku has one of the defacto leaders of the OTT platform companies and it will take a good chunk of the $70B US TV ad spend with hopes that Roku can succeed in a global expansion too.

Does it do anything distinct though? It provides a service not too dissimilar from Amazon, Google and Apple. The few review sites I looked at say Roku is preferred but ultimately, it provides the same service as others. Since I like using Airplay, Apple TV meets my personal needs.

Most users probably don’t care about ads and platform. I imagine the value of the TV is a greater consideration than the streaming platform. If people really want Twitch then they might go for Amazon.

Roku seems nothing more than one of many distribution channels. Now, SPOT is a distribution channel for music as well. How does Roku play with its partners? What’s the picture?

Partners and ecosystem

Roku needs partners to distribute its own hardware. It’s like Peloton. Needs the hardware inside a home so that it can monetize on the software for the life of the hardware. Amazon, Walmart and Bestbuy account for 72% of 2019’s Player sales. Quite the massive concentration. I guess it only makes sense as the retailers fight their own battles for supremacy.

On the content side, Roku also relies on content providers to be on their platform. In 2019, 3 streaming services represented 50%+ of all hours streamed. They wouldn’t name who but I imagine it's some mix of Netflix, Disney, PrimeVideo, Hulu… Who knows if the top 6 make up 80%....

Hardware partners are all in China and Southeast Asia.

Roku doesn’t share retention numbers but I guess it’s more the life cycle of a TV. I’ve used mine for 8+ years and I imagine TVs aren’t something people switch often. As folks switch to buying a Smart TV, as long as its Roku TV… it’ll be part of their lives for a while. Some consumers may also have multiple devices (like yours truly) so it might not be a winner-take-all. Which is what I think is true for OTTs as well.. People will subscribe to Netflix, Disney and others based on the content they want.

If Roku became the only platform to have all the OTTs, then it would make it stand out over others. But, they do not produce any content. If GOOG decided to pull Youtube out to make it exclusive to Android TV or if Amazon makes Twitch and PrimeVideo exclusive to FireTV… it can diminish Roku’s value. This is where I was hoping it might standout with some Netflix affiliation. If Netflix made it exclusive to Roku it would make it stand out… but it was spun out specifically because Netflix didn’t want to do that….

When asked to comment on Roku’s moat in a 2019 cordcutting.com interview, Woods said: "Our competitive advantage is our software – it is purpose built for TV (as opposed to being built primarily for phones or PCs). This results in a better UI, more content, and a lower HW cost structure.”

But does that matter?

Possibly, the big question is the value add Roku can give to advertisers. Like the value Facebook and Google adds, programmatic advertising for streaming is undoubtedly better than the TV ads of yesteryear. Roku says they can collect various data on streaming habits but they have limited access to non-Roku channels like Netflix, Prime Video etc…

Without any exclusivity to content providers and no control over content providers themselves…. Not to mention that their competitors are content providers as well…. I’m not as confident as others on Roku’s dominance.

I also wonder if Roku will be successful expanding globally. I’m always skeptical of North American companies believing they can expand to Asia as if what worked in NA will work in Asia. There is also an assumption that TV ad spend will move over to OTT spend… but given how TV ad spends were highly inefficient (inability to target specific users), I don’t think the full ad spend amount will transfer over. If I was running P&G and I learned billboards used to cost $10M but I get same/better results with $1M of FB ads, I’m not spending the full $10M again. Same for TV. If $1M of OTT ads achieves more than traditional $10M of TV ads, then why spend another $9M? I imagine there is a diminishing return curve for OTT ads as well.

These are all theoretical and I could be totally wrong. But I remain skeptical. Roku could definitely be in some 4-player oligopoly with Amazon, Apple and GOOG. Could very well see that. They could be bought out by the others too.

Roku is still a business that earns gross margins of ~40% and needs to be in a dominant position for it to have standalone long term value. They had an equity financing of $330M in 2019 so they don’t have a self-sustaining business yet and I’m not sure when they will hit a scale where they can continuously reinvest the cash they generate without the need for outside capital. They do have a ton of cash so maybe the financing was to be conservative and opportunistic but not something I like seeing.

Reinvestment.

Management has noted that R&D is the focus for the business and that is where most of the money is spent.

Whether it’s operating costs or stock comp, R&D is where the attention is and I do look at that very favourably. But I’ll now move into when I started losing interest in the business.

Culture

I was quite interested to find a 2015 3-page culture document Woods had written.

Few interesting facets shared was on how they chose not to do performance reviews. Woods noted that pay would not be tied to performance but some reviews on Glassdoor (3.9 rating) stated the idea of performance reviews didn’t exist. I thought this was unique. The view is that because they operate in a dynamic market, catering to objectives that could get outdated will hinder progress. I understand stand.

So pay is tied to market rates. This means it’s quite high since Roky primarily competes in Silicon Valley and this is what they use as a way to stay competitive.

Woods also shared a culture of ‘simple systems’:”.....if you need to buy a simple piece of equipment to do your job, you should do so without “asking”. Ask yourself, “What is this the simplest, but effective, way to do this?””

It also makes reference to a culture of letting people be adults and self-driven with a fire-fast model that seems supported by numerous Glassdoor reviews as well. But overall, nothing remarkable stood out for me.

Management

As far as depth of management goes, Woods is the key person. The CFO joined in 2015 but is stepping down and looking for a successor. The reason is to spend more time with his family. The General Secretary (legal) joined in 2014, the SVP of account acquisition joined in 2019 and SVP of platform joined in 2012. Overall, I find the lack of internal promotion troubling and it possibly speaks to a culture that doesn’t seek to develop but hire the right person for the job now.

I also see the use of titles like SVP to cite a possible bureaucratic structure that goes against the idea of moving quickly and building simple systems. You know what’s not simple? A title like senior vice president.

Moving over to ownership:

Assuming the Class B multiple voting (10 votes for Class B vs. 1 vote for Class A) converts 1-1 to Class A shares (the one available for the public)... Woods would have ~18% ownership of all outstanding shares. With things as is, he controls the business.

Seeing the execs having material ownership in the business is a major positive. What irked me was the compensation:

Wood’s equity is valued north of $3B but continuously paying himself large stock options rubbed me the wrong way. I just don’t see the necessity….. Execs also have the option to choose their equity compensation as 100% stock options, 100% RSUs or a 50/50 mix. I find RSUs to be closer to a longer term orientation compared to stock options… which I think vest monthly in-the-money… so this doesn’t show me a management team that actually thinks long-term.

Wait and See

I think Roku’s story is still a wait and see. It’ll be interesting to see how they meet the challenges brought on by their competitors. I could see the thesis being placed on Roku being a bet on an industry shift to OTT ads and their position allowing them to capitalize on it…. But as an individual company… I am uncertain how they will look in 2030.

I think there are better businesses out there in situations that are not as complex and difficult… so I may just avoid this. But specifically.. The management rubbed me the wrong way and that’s a bias I have.

Disclaimer - I’m writing this for myself. For my past, present and future self. Much of what I write is my opinion. If it somehow ignites agreement in you then great, I’d love to hear about it. If it sparks disagreement in you, don’t reach out because I don’t care for it. There always are obvious exceptions and the flawed person in me hasn’t considered them all.