Atlassian (TEAM)

Looking into the company on a mission to unleash the potential of every team. Sharing high level thoughts on the culture, management and business model from shareholder letters and annual reports of Atlassian.

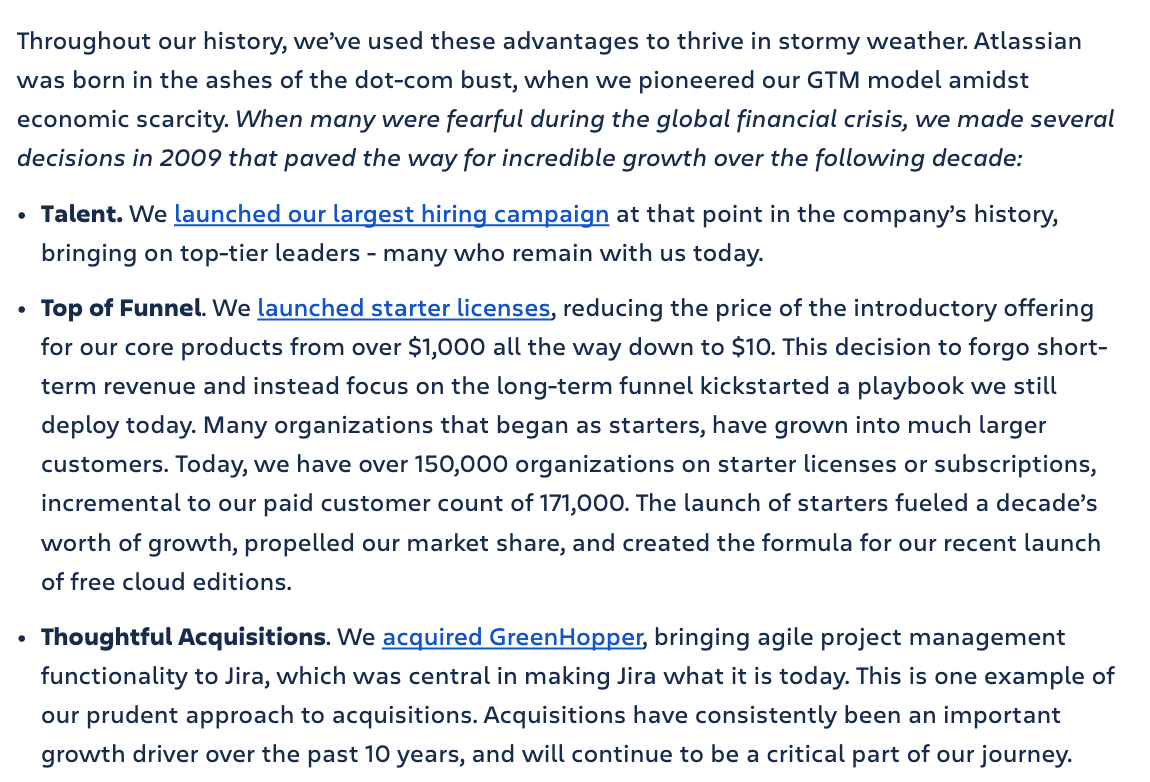

Atlassian (TEAM). A business that started in 2002 to help software engineers. A suite of products that’s become quite essential during the era where ‘software is eating the world’ and every business will need a team of developers.

My fascination with Atlassian did not begin as a user. In fact, I didn’t care much for it. I was getting accustomed to using Jira, Confluence and the whole Kanban system but didn’t think it was any kind of breakthrough. What was interesting was that this was a new workflow software that was being adopted by a large bureaucratic management consulting company. That was news to me. Ringing “ERP-like” bells in my mind. Essential products at low cost to the user….that gets me excited.

But the product aside, my fascination started with the fact that the company was headquartered in Australia. It’s rare to see widely adopted software originating from outside Silicon Valley… even the US. Then, I realized its co-founders were also co-CEOs (Mike Cannon-Brookes and Scott Farquhar). Turns out the company doesn’t even have a sales organization.

This was the shit I liked.

After entertaining myself with some interviews, it made it hard not to start liking the founders.

They started a business because they didn’t want to wear suits/ties and have to report to anyone.

From the first year, Atlassian was cash flow positive. Quite rare to see ‘fast growing’ companies continue to stay FCF positive from the get-go.

When receiving VC funding, they didn’t care much for the money but needed help scaling. They made it a fully transparent process where all documents (including Q&A from VCs) were in a shared folder for all VCs they were speaking with. VCs didn’t like this transparency apparently. But the co-founders wanted an open process.

When it came to deciding on a VC, the co-founders wanted simple/honest once again. They said they’d only look at 1 page contracts (or is it called term sheets?) and Accel’s Rich Wong was the only one that made it happen for them.

Though they are billionaires, Mike takes a bus to work and Scott apparently splurges on Uber’s premium tier on a few occasions. Quite down to earth.

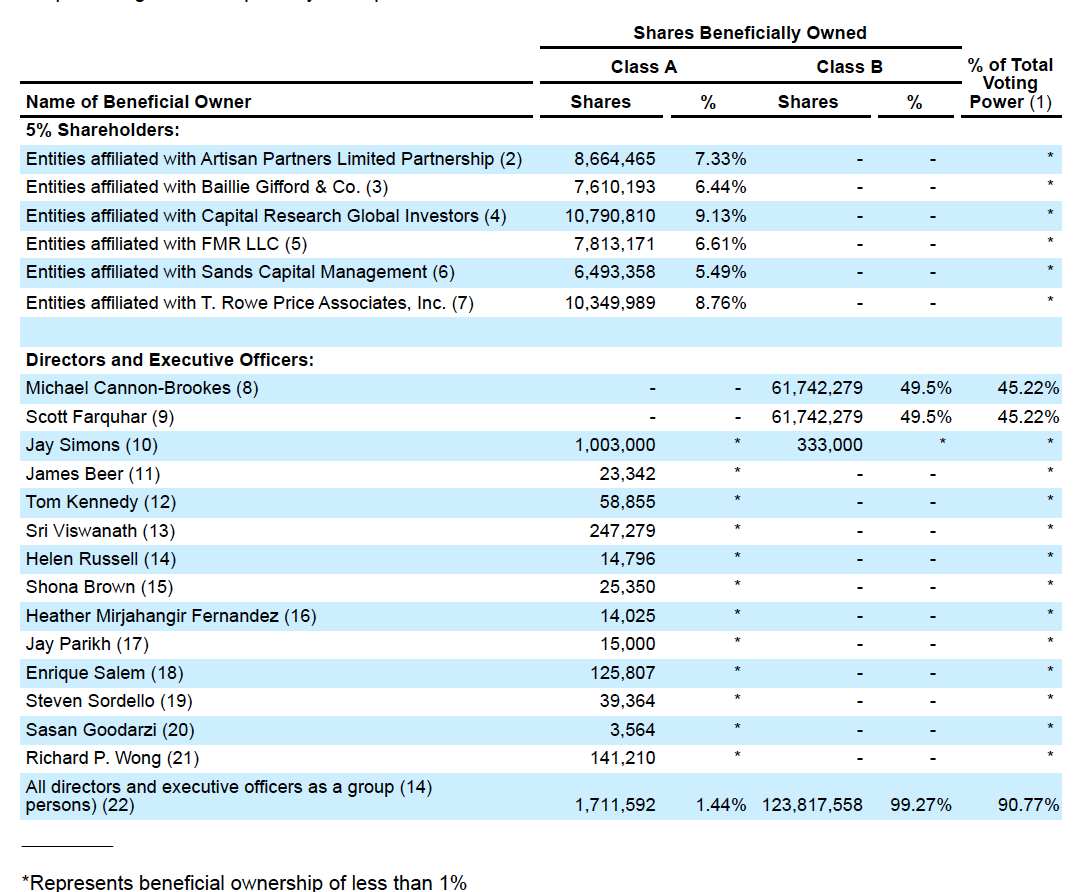

Show Me Where Your Money Is

Naturally, the first test is to dig into compensation and proxies. It’s one way to get a sense of how the talk translates to action. I personally find it hard to care about companies that don’t have owner-operators. It’s also a smell test. Sometimes it just doesn’t look right.

Let’s look at ownership.

As of 2019, the co-founders controlled TEAM and have 50% of all outstanding shares (post conversion of B shares to A shares). Since 2017 (they IPO’d in 2016), they’ve each sold off ~7% of their Class B shares to realize their wealth. No issuing of Class A options to themselves. Reminds me of what the GOOG co-founders are doing (and having been doing since the early post-IPO period). It’s also worth noting, the majority of the Class B shares are held in trusts and the co-founders have been selling off the equity they directly possess outside the trust (which is about ~7M shares each now).

Looking into how they’re compensated, it’s quite reasonable. They’ve each received ~$300K USD annually from 2017 to 2019 with plans to reduce their compensation to ~$75K AUD as that is the minimum in Australia. I imagine this is closer to the ‘symbolic’ nature much like the GOOG co-founders receiving $1 each.

As far as equity compensation for the rest of the executive team is concerned… I don’t have much information on that. Cash compensation for the executive team amounted to ~$4M and it seems that excludes the ‘long-term incentive’ payments that seem to be in the form of RSUs that are based on individual performance. No metrics. But, this comes down to each c-suite exec receiving ~$700K in cash compensation. A reasonable sum with nothing more to add.

A look into the management team….

Looking at the executive team, there seems to be a constant shift.

The chief people officer has changed twice in the last 5 years (since IPO). Both times it’s an external hire. For a business that continues to tout that people are their “most important asset”, why do they never promote this position from within? I’m rather fearful that given there are so few companies out there with great cultures, bringing outsiders will pollute the culture rather than elevate it.

Jay Simons, long-time president, left in 2020 and was succeeded by Cameron Deatsch. This was an internal promotion and that shows some consistency. But…. I wonder why Jay is departing after joining in 2008… it’s unfortunate to see the only long-time executive leave.

This consistency is broken again with the CFO role. Murray Demo left after 6 years to be succeeded by James Beer in 2017-2018. Though CFOs are C-suite, the role tends to be the most ‘mercenary’ like in that new CFOs are always brought in for IPOs and another one seems to be brought in for different stages of a company’s life cycle. If my own experience working with CFOs from my accounting days, and the continuous overcorrection CFOs around me seem to do to “prove” they are so much more than basic number crunchers….. Most seem to be just that. Number crunchers keeping the lights on. This might offend some but once again… most of peers are some kind of controller, VP of Finance and once again… most couldn’t care about their company, product and not in the least… the people. Although the departure of CFOs are possible signs of financial mischief…. Maybe I should accept it as normal that CFO departure will be more frequent and many are just employees. Not owners.

Looking into the others on the leadership team, the CTO, chief legal and chief of staff all joined around the 2016 time period. Though it’s probably worth noting the chief of legal was promoted from within in 2019. Overall, it’s an executive team that is ‘green’ when considering the company’s 18 year history. I would probably pay particular weight to the CRO, CTO and CPO positions given their impact to the product teams. With that lens… there seems to be an indication of developing and retaining top talent with the CRO promotion but still too early to tell.

The Quarterly Shareholder Letters

Believe it or not, this long essay resulted from a quest to read all the shareholder letters management put out since 2017. My goal was to learn more about TEAM’s organization/culture through the letters. I was hoping they would shed some light to how the company was run.

The letters all follow a similar format with a look into TEAM’s product portfolio and whatever is the new product of the quarter, then some case studies into their customers (which is decently helpful if you’ve never used their product but it’s still at a high level) then a financial overview of the same 4-5 metrics.

Overall, the letters are intensively product focused. The co-founders constantly tie the product back to how it can help the customers and that’s been the singular theme that remained consistent with every letter. But, there are some nuggets tackling various aspects that piqued my interest so I thought I’d share what the founders had to say:

Metrics:

Every quarter, management highlights revenue, gross/op. Margins, net income per share diluted, balance sheet health (cash) and FCF

M&A:

Culture is one of the key pillars the co-CEOs have often mentioned in the letters and transcripts in earnings calls (other two are business model and product). As the co-CEOs noted when they acquired Trello in 2017: “And while it's hard to describe with mere text, our cultures are a great match. Trello CEO Michael Pryor and his team share our passion for product innovation and putting customers first…”

Culture

In reference to the ‘open’ culture in 2017: “Atlassian products remove barriers within and between teams, giving them simpler ways to plan, collaborate, and deliver work.By making work visible across the company by default,it can be shared quickly and discovered easily. That openness breeds trust. And trust, in turn, breeds effective teams, who are not only loyal customers, but vocal champions of this new way of working.”

A theme continued in 2018: “Openness denes our company, our culture, our products, and how we serve our customers. Because we believe working open leads to better outcomes, we bake it directly into our products. Confluence pages are open by default to help teams collect and share ideas from everywhere. Jira surfaces information about projects that allows teams to move faster . Trello makes it easy to organize ideas into lists so teams can hit the ground running. These products start " open" – a small but important difference in how we help teams connect, share and work together.”

“Core to our growth since Atlassian’s inception is the fundamental belief that software should be bought and not sold, and that we can reach all customer segments of the markets we serve through incredible product, affordable pricing and amazing customer service.”

In 2020 with the departure of Jay Simons, President: “we create two bobbleheads for Atlassians when they hit their ten-year anniversary - one for them to keep, and one for us.”

Their response in the 2020 COVID period: “We’re taking action to respond to employee feedback through on-going surveys, and so far: 95% of our employees believe we’re acting and communicating with clarity; and 85% of our employees say they feel supported and connected to their teams. We’ll continue to empower our teams to thrive in an uncertain time.”

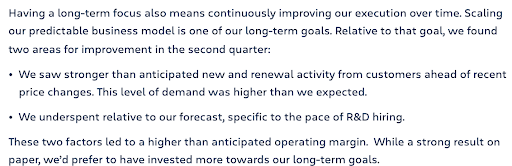

Focused management

Referring to TEAM’s exit of the real-time communication space in 2018 by selling their IP of Stride and Hipchat to Slack. Possibly leading to combined approach in the future as more of TEAM’s products get integrated with WORK’s. It makes you wonder if the future of software will be a number of mid-large players working together to specialize in specific segments. Future letters mention the partnership with inVision (design) and Zoom (video) and it makes one wonder how it could be a group of “friends” running the gambit of ‘work’ together.

Instead of one company doing it all but kind of an international alliance so to speak… TEAM has noted they made strategic investments with each of their partners but I’m not sure how big this is and in what structure it is. TEAM doesn’t show up in Slack’s proxy statement as a major equity holder. I’m not familiar with Slack or Zoom but inVision is known to have a strong culture as one of the OG remote-only companies.

Long-term Vision:

In 2015 IPO letter: “Atlassian is a special company. We are unlike any other enterprise software company you've seen before. We have an ambitious mission, a decade-long history of consistent growth and free cash flow, a culture of innovation, and a unique model that both propels our existing business and opens up future growth opportunities.”

In 2019’s Q4 letter: “We are building an enduring and durable company grounded in our long-term perspective. We articulated our commitment to long-term thinking in a Founder Letter from our 2015 IPO Prospectus. In this letter we outlined a set of beliefs we considered to be a core part of our past achievements and key to our continued success. These beliefs continue to guide our near-term priorities and longer-term focus.”

In 2019, regarding their early investment in moving to a cloud-first company. Some ~90% of new customers are on their cloud products: “We believe the Cloud is best for our customers. We chose in 2007 to invest early in the Cloud as a delivery platform for our products -- in front of market maturity and customer demand……. Today, these investments have paved a path to competitive differentiation, future growth, and greater customer acquisition. Our Cloud platform and Cloud products are our most important priority and essential to our enduring success. They provide the foundation for us to scale to both hundreds of thousands of companies, and companies with hundreds of thousands of users.”

Future aim: “Today, we have over 10 million monthly active users (MAU) on our Cloud products. Our goal is to reach over 100 million MAU of our products and services.”

2020:

Competitive Advantage

With the introduction of another free edition for Cloud products in 2019 to attract smaller teams: “We view pricing as a competitive advantage. We believe that software should be bought, not sold, which has always driven us to be a high-value, low-price leader.”

2020 Q3 letter during COVID: “In the coming months and quarters, we will play offense by leveraging three core competitive advantages: our culture, our business model, and our strong portfolio of products……..We have a history of trading short-term growth to drive stronger long-term outcomes. We have an agile, resilient culture, an appetite to use our business model to make bets other companies can’t make, and a strong portfolio of products poised to take share in massive markets.”

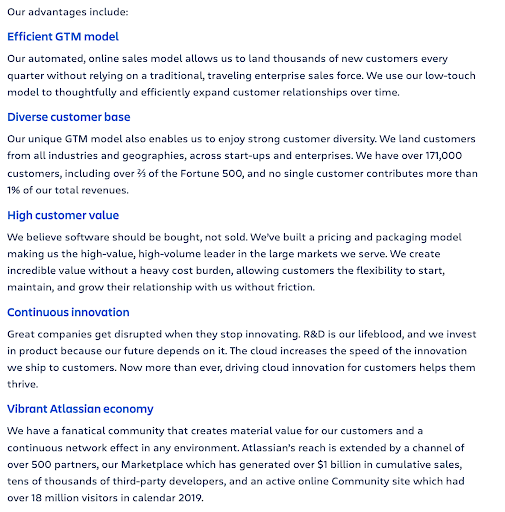

What the annual report sheds light on Atlassian’s organization.

A company with a mission: “to unleash the potential of every team.”

As I mentioned before, TEAM doesn’t have what many would consider a “traditional sales” organization like many enterprise software companies. Most in the industry have large teams of account managers that woo and handhold other executives of large companies. A focus on convincing the decision-makers of each large company.

Instead, they focus on pure volume of users (not just # of companies) and rely on a work-of-mouth expansion of its products. Not to use a negative analogy but it’s kind of like how a virus spreads. It starts with one node and expands rapidly throughout the organization. That’s TEAM’s distribution model.

Much like the culture of transparency management hints at, pricing is also transparent. Users will see all the available options without fear of ‘back-door’ dealings and wondering if they are getting a fair deal. Eventually, this bottom-up adoption would result in an organically growing network where the top decision-makers end up having to adapt to the system that people (those actually doing the work) use.

This creates an organization that can (and does) focus intensively on the product. It uniquely positions TEAM to invest all the sales $$s competitors would invest in to be re-allocated to TEAM’s own R&D/Product teams. One would expect this focused investment in products to compound in value over time. Leading to the reinforcing view of a ‘product’ culture that you get from reading the shareholder letters.

The annual report even shares the company’s values:

This might not mean much but there are indications of management trying to showcase how ‘what they do’ translates to ‘what they preach’. I could make the connection with the team-obsessed culture given that they a) have a co-CEO structure that requires a team at the top and b) the company runs on their own team-based software.

In regards to a culture of transparency, the products are adopted through TEAM’s website. The prices are all there. Even their VC process focused on transparency. I also think the product adoption process showcases a long-term orientation. A sales-focused company would have faster sales growth as a single sale could lead to larger sales immediately (i.e. sell to a decision-maker of an entire company) and the organic adoption path TEAM’s chosen will take time to build momentum. But, it’s possibly the more resilient path long-term.

It seems that a focus on the customer was also top of mind with the start of the company as well. Not just that the founders built Atlassian as a result of a problem they faced, but that the company gets its name from the Greek Titan Atlas who held up the skies. Apparently, it ties to the kind of legendary service they want to provide to their customers.

Two cents on competition

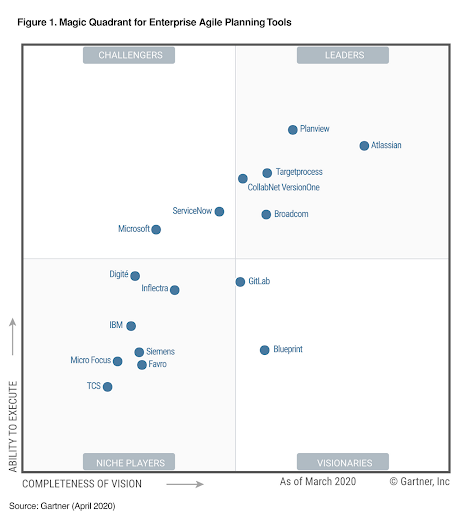

I’m not sure who TEAM’s direct competitors are. They break it down by the customer groups (i.e. software, IT and business teams) but it seems to be a mix of IBM, GOOG, MSFT, CRM in regards to big products… and a number of specialized players like Asana, PagerDuty etc...

Maybe this gives us an idea:

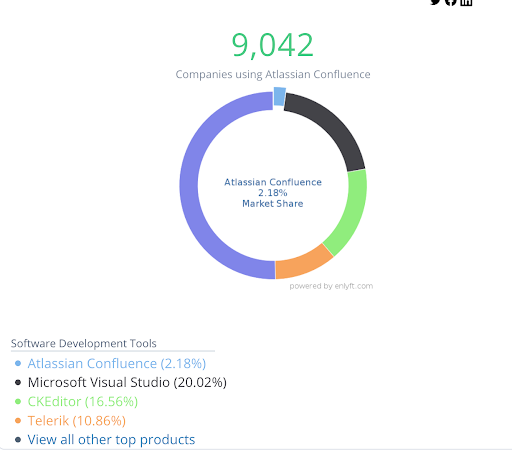

But, about ⅔ of TEAM’s revenue comes from JIRA + Confluence. They are the breadwinners for now so maybe looking at the direct competitors of these products gives a better idea.

I get the sense that MSFT is the big fish TEAM is competing against. This could be daunting to go up against such an entrenched competitor… but so far, TEAM’s been able to hold its own. What’s fascinating though is how Slack (WORK) and TEAM have partnered up and they are both up against MSFT… Is it just me seeing the irony that TEAM + WORK is partnering up against MSFT?

Who uses TEAM? A quick look at customers.

In 2019, they had 150K+ customers and 125K+ in 2018. Simply put, most of TEAM’s customers are small businesses. The question is how many of its monthly ~13M users are from the 100+ large customers. Also, no single customer represents more than 1% of revenue. And they have all kinds of large companies like NASA, Visa, Red Bull, Adobe, Square, Lululemon, AirBnb, Netflix, VMware, national pension plans, EU football clubs etc…

Management defines their addressable market as the Fortune 500,000 and the global 800M knowledge workers. Technical professionals (including software developers) represent ~100M users. Interesting how they use ‘users’ as a metric for their TAM. Maybe that’s more important when the products are going to be intertwined further throughout the life of the user.

Making Money

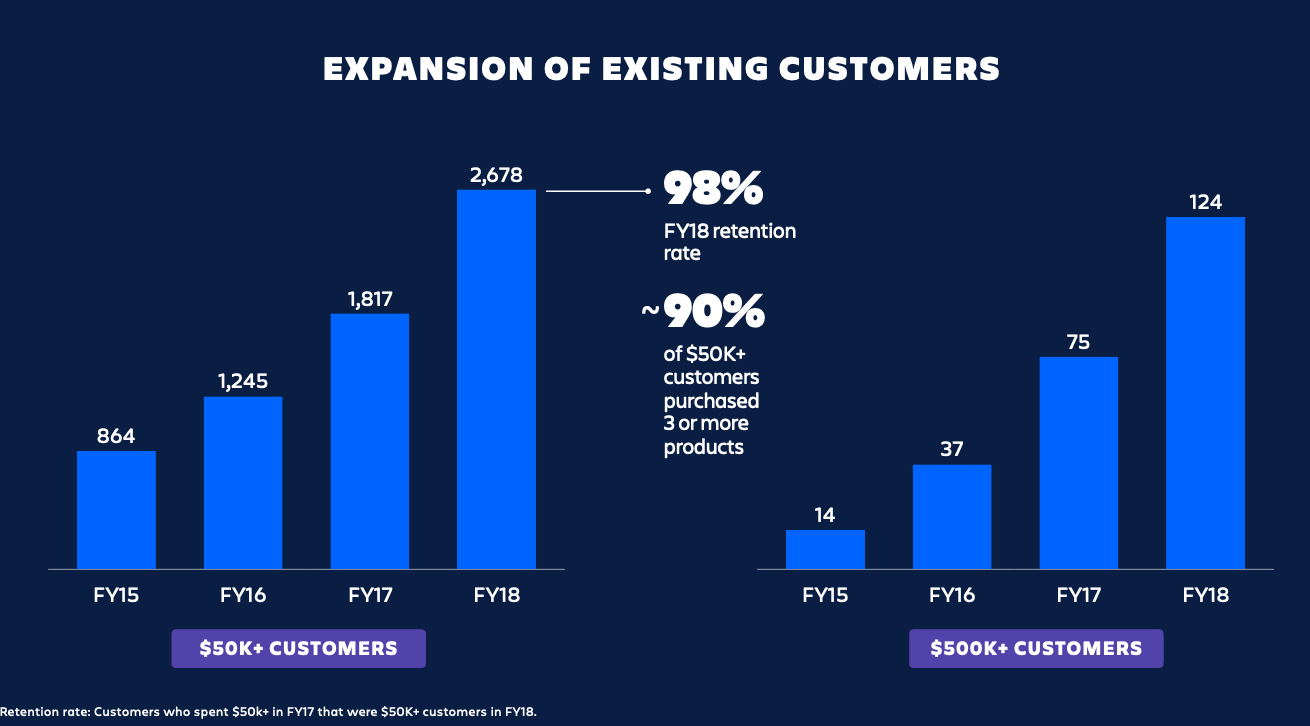

As far as money goes, about 85% are considered ‘recurring’ in nature through subscriptions or maintenance required on the one-time perpetual license products. Management also noted ~90% of sales come from existing customers.

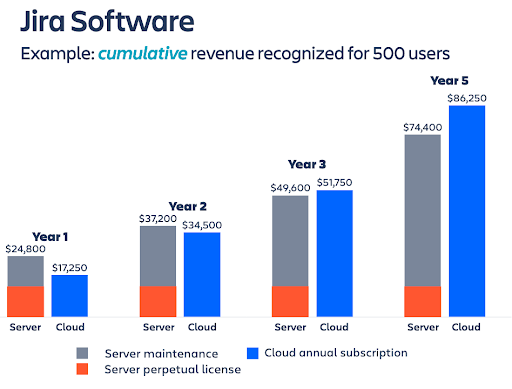

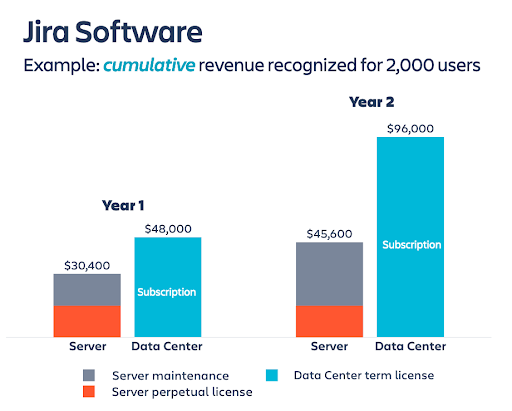

Ideally, they want to move most customers onto the cloud product (subscription revenue) for better economics:

Especially with more users:

As expected, much of sales is recurring and a shift to the cloud may present slower near-term growth but better economics over the long-term. But what matters? Is it the singular focus to increase MAU? I would prefer to see the subscription revenue growing (indicating a growth of the cloud user base). Revenue growth also incorporates the result of customers adopting multiple products…. So does that mean the focus should be the growth of customers? Is the growth of customers (especially the larger ones) an indicator of true organic growth for the business? To see smaller customers grow into larger ones through increased volume of users + products adopted? Because I imagine the most important factor proving the success of TEAM would be the viral expansion of TEAM within an existing customer. If Visa only uses TEAM within a singular team and no one else loves it, is convinced of it… then it’s not as valuable.

If only we knew how many customers continue to move up the scale..

A quick word on valuation.

“????????”

That’s really how I feel. My 20sec back of the envelope shows me ~2-3% yield on owner’s earnings. TEAM has been growing fast in the past. I see it unlikely it will repeat 40%+ growth rates in the future. However, I could see it being the business that grows 20% for 20 years as it changes customer mix to the cloud products from on-prem. The nature of TEAM’s distribution is a slow expansion inside organizations. I imagine these will take longer to blossom… leading to a thought that it would probably be closer to the lengthy 20 years 20% growth than 5 years of 50% rate.

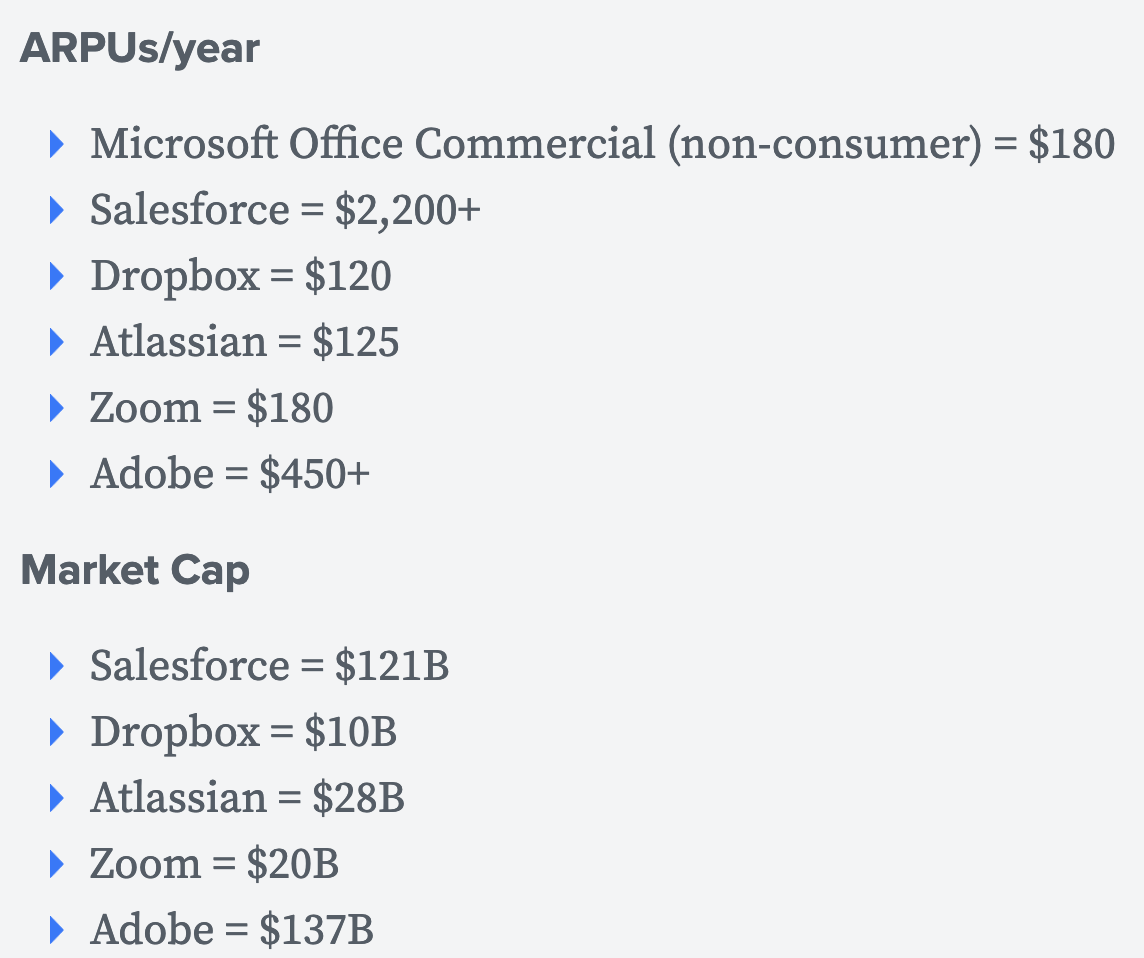

I also wonder if the lack of sales and a rather… organic sales process makes much of TEAM’s sales growth organic in nature. Absent the obvious gains from acquisitions. I imagine the ARPU will continuously decrease as they offer more discounts and free trials etc… When you are FCF positive, you have all the leeway to do that.

https://nextviewventures.com/blog/slack-s-1-will-arpu-drive-long-term-value/

I feel a lower ARPU would be favourable for TEAM in the long run. Its suite of products are scalable and can be applied to a 20 person startup and 5,000+ large company. The lower ARPU allows for greater adoption and what you’d want to see is that the products become so embedded early on that TEAM will see those small companies become the large organizations of the future and expand volume over time.

There is an argument that TEAM’s TAM is quite narrow because of the focus on IT/Devs. With technical individuals making ~100M and TEAM currently having ~10M MAUs, total domination there would be 10x. But I think the lines of ‘tech and non-tech’ will get blurry over time. It’s like saying only accountants used excel in the past but it became everyone… and now most data/quant folks don’t even touch excel and that’s left to the ‘non-tech’. Work will probably evolve to encompass a wider range of folks who are associated with “product” and that’s where TEAM will continue to play a role.

So… what to make of the low IRR? Could TEAM become a $450B company in 10 years? Possibly. When compared to organizations like MSFT, IBM and CRM…. I feel most aligned with TEAM’s management.

Disclaimer - I’m writing this for myself. For my past, present and future self. Much of what I write is my opinion. If it somehow ignites agreement in you then great, I’d love to hear about it. If it sparks disagreement in you, don’t reach out because I don’t care for it. There always are obvious exceptions and the flawed person in me hasn’t considered them all.